EURUSD likely to hold in directionless mode until the ECB but the risk of fresh weakness exists despite bullishly aligned techs

The Euro holds in directionless mode on Tuesday, unable to finally break above falling 30SMA pivot, but strong downside rejection earlier today signaled that the downside is protected for now.

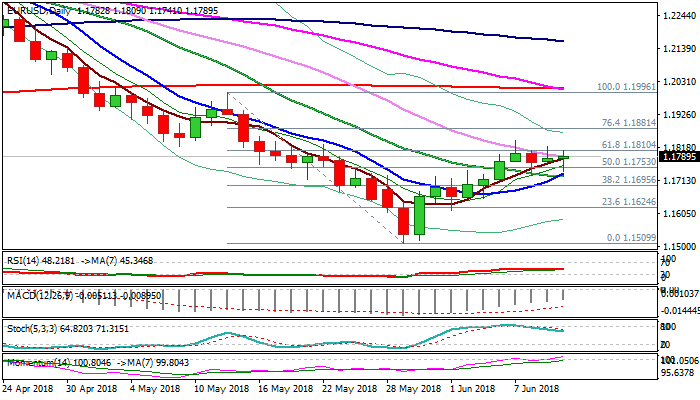

Bullish setup of daily techs and strengthening momentum are supportive factors for further advance, but the sentiment was soured by downbeat German ZEW (Jun -16.1 vs -14.6 f/c and -8.2 in May) and French non-farm payrolls data.

Focus turns towards the ECB policy meeting on Thursday which would provide fresh direction signals, with the pair likely to remain in a quiet mode until the release.

The ECB is expected to stay unchanged, with focus on possible QE policy changes and economic projections.

The economic outlook may not be supportive for the single currency, as recent soft data from the EU warn of slowdown.

All these factors could increase pressure on Euro, which could result in fresh weakness and current upticks seen as positioning.

The notion could be supported by repeated failures to clearly break above pivotal barriers at 1.1789/1.1810 (falling 30SMA / Fibo 61.8% of 1.1996/1.1509 bear-leg).

To avert existing downside risk, break and close above 1.1789/1.1810 pivots, as well as 1.1839 (07 June high) is required.

Res: 1.1809; 1.1839; 1.1881; 1.1938

Sup: 1.1753; 1.1735; 1.1710; 1.1695