COPPER correct on profit taking after nearly 7% rally

Copper stands at the back foot on Tuesday after strong fall on Monday, when the metal was down nearly 1.5%.

Profit-taking on almost 7% rally in six-days, which was driven by fears of significant reduction in supply from the world’s biggest copper mine in Chile, dragged copper price lower, helped by reduction in copper inventories.

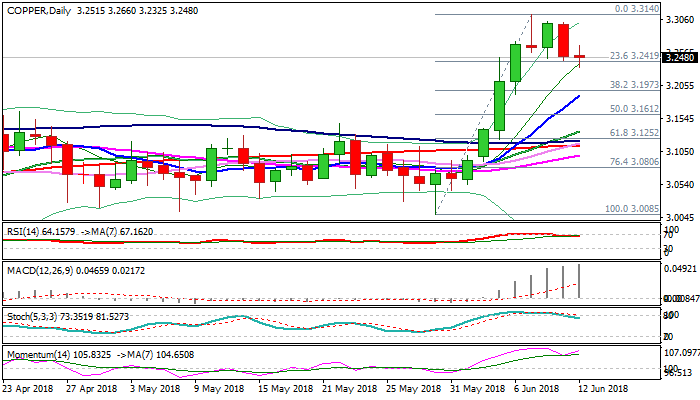

Limited correction could be likely scenario as daily MA’s are in firm bullish setup and momentum is strengthening again that makes overall picture firmly bullish.

Corrective pullback faces strong supports at $3.1973 (Fibo 38.2% of $3.0085/$3.3140 rally); 3.1935 (former high of 19 Apr) and $3.1904 (rising 10SMA) which are expected to contain correction and keep larger bulls intact for final push towards key barrier at $3.3200 (28 Dec peak).

Conversely, bulls could be sidelined for deeper correction on break and close above rising 10SMA.

Res: 3.2660; 3.2800; 3.3035; 3.3140

Sup: 3.2325; 3.1973; 3.1904; 3.1612