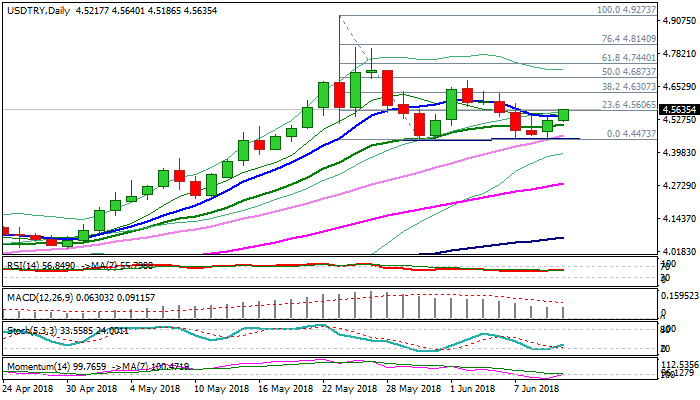

USDTRY extends recovery, forming a higher base at 4.45 zone

The USDTRY extends recovery from post-CBRT low at 4.4507, as lira ran out of steam after being boosted by central bank’s rate hike last week.

Initial signal of formation of higher base at 4.45 zone is generating after lira failed to break key obstacle at 4.4473 (30 May low) on post rate hike rally.

Fresh momentum is building and supports recovery after rising 30SMA contained dip.

The pair probes above 10SMA (4.5372) close above which would bring daily MA’s into full bullish setup and signal further recovery.

Probe through Fibonacci 23.6% of 4.9273/4.4473 pullback at 4.5603 was positive signal, however, recovery needs extension and break above 4.6307 (Fibo 38.2%) to generate reversal signal, which would be confirmed on lift above 4.6782 (04 June high).

On the other side, bearish scenario requires firm break below 4.45 base to spark fresh rally of lira and expose targets at 4.4000 (psychological support) and 4.3724 (Fibo 61.8% of 4.0294/4.9273).

Fed’s rate decision on Wednesday would provide fresh direction signals, as focus turns towards Turkey’s elections, due on 24 June, with election results expected to be of lira’s main drivers.

Investors are looking for the outcome of Turkey’s election as re-election without parliamentary majority would limit President Erdogan’s power, while victory with parliamentary majority would give further power to the President, known by his unorthodox stance on monetary policy, which would bring further concerns to investors.

Res: 4.5868; 4.6000; 4.6307; 4.6782

Sup: 4.5186; 4.5051; 4.5000; 4.4507