EURUSD – n/t bears resume after Monday’s Doji; risk further easing

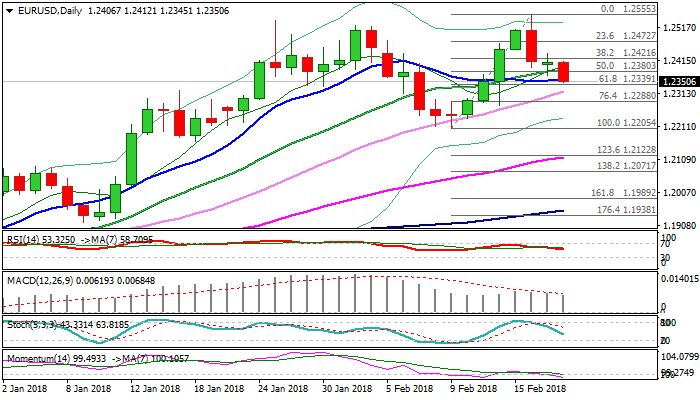

The Euro stands at the back foot on Tuesday and accelerated through support at 1.2380 (20SMA), triggering fresh extension of bear-leg from 1.2555 (16 Feb high) after Monday’s action ended in Doji, signaling indecision.

Studies on lower timeframes turned in bearish mode and warn of further easing after strong bearish signal was generated on Friday’s bearish outside day.

Fresh bearish extension below on Tuesday so far cracked 10SMA (1.2353), eyeing next pivot at 1.2339 (Fibo 61.8% of 1.2205/1.2555 upleg) close below which will be bearish signal and would unmask key support at 1.2205 (09 Feb low).

Overall structure is bullish and sees current easing as consolidation before fresh push higher, with dips to be contained by rising 30SMA (1.2318).

However, risk of deeper dips on break below 1.2205 pivot exists and is signaled by daily RSI/MACD bearish divergence.

Bearish scenario needs close below 1.2205 to signal double-top (1.2237/55) on daily chart and spark stronger correction of 1.553/1.2555 rally, towards 1.2172 (Fibo 38.2%) and 1.2116 (rising 55SMA).

German ZEW economic sentiment report is key event from the EU today and could further pressure the single currency on weaker than expected release (Feb f/c 28.4 vs Jan 31.8).

Res: 1.2380; 1.2421; 1.2445; 1.2471

Sup: 1.2339; 1.2318; 1.2275; 1.2205