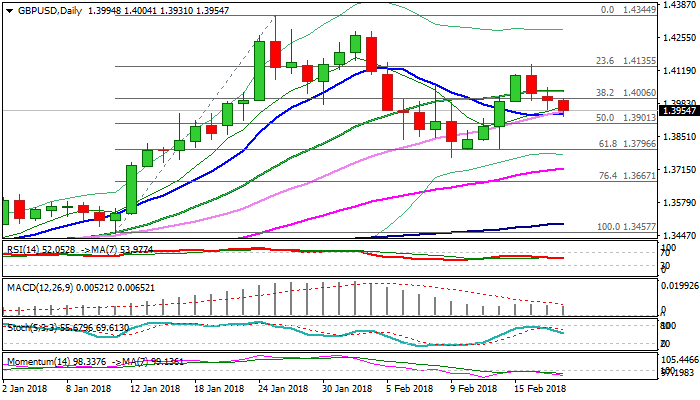

GBPUSD maintains bearish n/t bias, cracks 10SMA pivot

Cable remains in red for the third straight day and extends pullback from 1.4144 (16 Feb high), probing through converged 10/30SMA’s at 1.3951.

Repeated close below 20SMA (1.4030) on Monday and loss of psychological 1.40 support were negative signals, which could be boosted by close below 10SMA today.

This could further weaken daily techs (daily MA’s are turning to bearish setup and fresh bearish momentum is building) for test of pivotal 1.39 zone (base of thick 4-hr cloud / Fibo 61.8% of 1.3764/1.4144 upleg) and risk extension towards key supports at 1.3796 (Fibo 61.8% of 1.3457/1.4344 / 12/14 Feb higher base) and 1.3764 (9 Feb low), loss of which would generate strong bearish signal.

To sideline immediate downside risk, lift and close above 1.4030 (20SMA) is needed.

Res: 1.4000; 1.4030; 1.4054; 1.4104

Sup: 1.3900; 1.3854; 1.3796; 1.3764