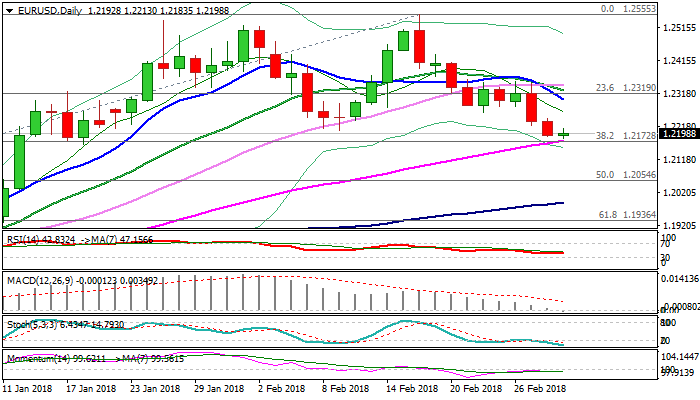

EURUSD – narrow consolidation to precede final push towards strong Fibo support at 1.2173

The Euro was marginally higher in early European trading, probing above 1.22 handle after hitting new low at 1.2183 in Asia.

Near-term sentiment remains negative as dollar continues to firm, boosted by optimistic tone from Fed’s Powell, which fueled hopes for stronger pace of US rate hikes in 2018.

Wednesday’s close below 1.2205 (09 Feb low) was bearish signal for extension and test of next key supports at 1.2173/76 (Fibo 38.2% of 1.1553/1.2555 ascend / rising 55SMA).

Bears are expected to attack these supports, as firm break here would generate next strong bearish signal for fresh acceleration towards 1.2089 (04 Jan former high) and 1.2054 (Fibo 50% of 1.1553/1.2555 rise), with psychological 1.20 support expected to come in focus on stronger weakness.

Very limited upside action was seen so far, with stronger upticks to be capped by falling thick hourly cloud (cloud base lies at 1.2246).

German and EU Manufacturing PMI data are the highlights of the European session today (Feb forecasts show unchanged values from the previous month), with a batch of US data being in focus in American session.

Res: 1.2213; 1.2246; 1.2265; 1.2284

Sup: 1.2183; 1.2173; 1.2156; 1.2089