GBPUSD consolidates after strong fall previous day; outlook remains negative

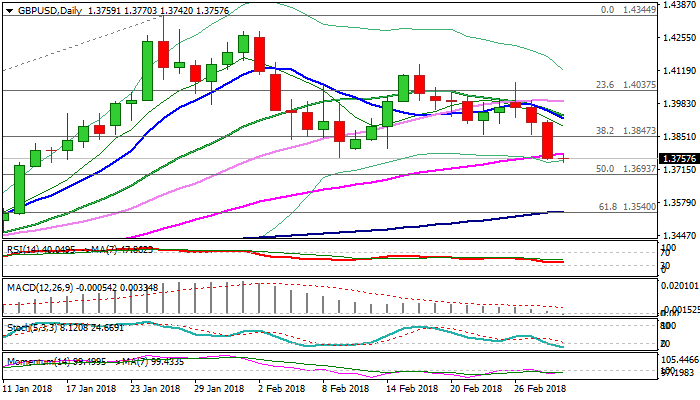

Cable holds within tight consolidation in early Thursday’s trading after suffering heavy losses on Wednesday, which resulted in cracking key supports at 1.3780/64 (55SMA / 09 Feb low) and break into rising daily cloud.

Sterling remains under pressure on stronger dollar and Brexit concerns and could extend lower after bearish signals were generated on Wednesday’s close below former key supports.

Also, formation of failure swing on daily chart is negative signal, which could spark further weakness and harm broader longs.

Bearishly aligned daily techs (MA’s in bearish setup / 14-d momentum in negative territory and Wed’s long bearish candle weighing) work in favor of extension of bear-leg from 1.4069 (26 Feb lower top) towards 1.3703 (daily cloud base), to generate fresh bearish signal.

Broken 55SMA marks initial resistance at 1.3780, with daily cloud top (1.3841) expected to cap upticks.

Key events for sterling today are release of UK Manufacturing PMI (Feb f/c 55.1 vs 55.3 in Jan) and meeting of UK PM Theresa May with the chairman of EU leaders Donald Tusk.

Res: 1.3780; 1.3841; 1.3856; 1.3916

Sup: 1.3742; 1.3703; 1.3674; 1.3618