EURUSD – Pivotal barrier under increased pressure, economic data eyed for fresh signals

EURUSD remains steady and holding near 3 ½ month high on Tuesday, with little impact from weaker than expected EU economic data.

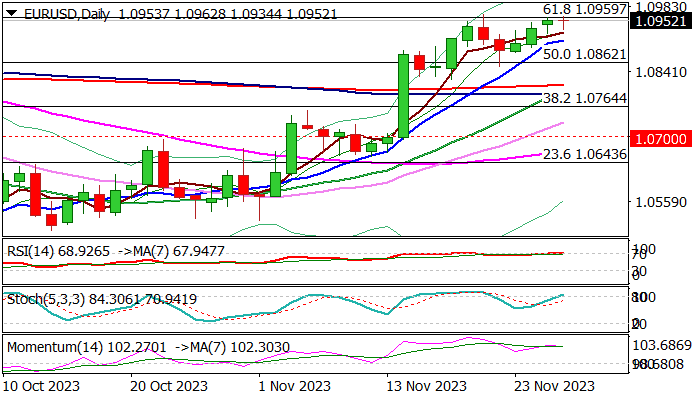

Bulls continue to pressure cracked Fibo resistance at 1.0559 (61.8% of 1.1275/1.0448, which proved to be significant barrier, after resisting two attacks.

Bulls remain firmly in play on daily chart, with strong positive momentum, moving averages in bullish configuration and converging 20/200DMA’s about to form a golden cross and reinforce signal, while the action remains supported by rising thick weekly Ichimoku cloud.

Rising 10DMA, which tracks the price action for almost one month, offers initial support at 1.0909, where downticks should find firm ground, to keep bulls intact and guard lower pivots at 1.0862/52 (broken Fibo 50% / Nov 17 higher low.

Firm break of 1.0959 barrier to generate initial signal of bullish continuation and expose next targets at 1.1000/80 (psychological / Fibo 76.4% of 1.1275/1.0448).

Caution on possible extended consolidation / shallow pullback as daily studies are entering overbought territory.

Expect stronger signals from economic data (EU CPI / US GDP and PCE) due on Wed/Thu.

Res: 1.0965; 1.1000; 1.1065; 1.1080

Sup: 1.0925; 1.0909; 1.0862; 1.0852