GOLD holds above $2000 on weaker dollar, dovish Fed

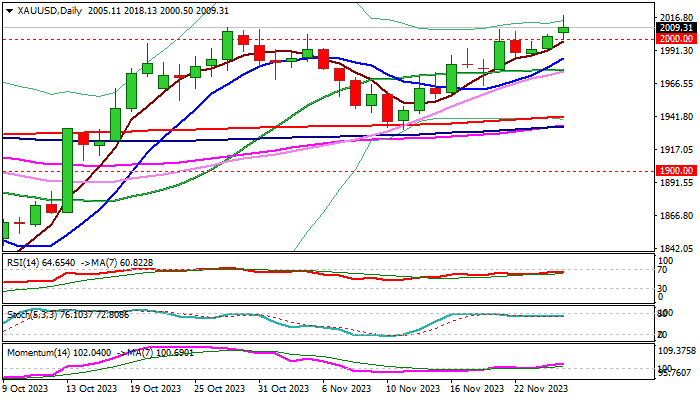

Gold price is establishing above broken psychological $2000 barrier on Monday and hit the highest in over six months.

Fresh probe above $2000 and break above former top of Oct 27 ($2009) contribute to bullish near-term outlook.

Close above these levels will boost bullish signals and open way for further advance, as gold remains underpinned by weaker dollar on growing expectations that the Fed is done with policy tightening and may start cutting rates in 2024.

Technical picture on daily chart is firmly bullish and supports the action, though markets focus on releases of key US data this week (GDP and PCE Price Index), for more signals about Fed’s next actions and metal’s near-term direction.

Broken $2000 level reverted to initial support, followed by higher low of Nov 23 ($1988) and rising 10DMA ($1985) which should contain extended dips and keep bulls intact.

Res: 2018; 2027; 2039; 2048

Sup: 2000; 1988; 1985; 1979