Extended consolidation to precede fresh bulls

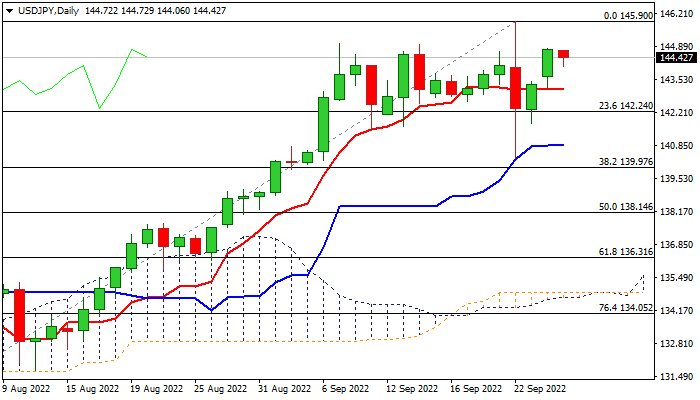

The USDJPY edges lower in Asian / early European session on Tuesday, after two-day rally lost steam on approach to initial barrier at 145.00 (former tops), as risk appetite starts to return to play.

Overall picture remains bullish, but near-term action is losing momentum, after large swings on Japan’s intervention failed to register a clear break out of near-term congestion, suggesting that the intervention did not manage to provide a substantial support to Japanese yen, while the dollar remains well supported by safe-haven flows and hawkish Fed.

Daily Tenkan-sen and Kijun-sen are in bullish setup but turned sideways, signaling prolonged consolidation before bulls regain full control.

Daily Tenkan-sen offers initial support at 143.12, followed by 142.24 (Fibo 23.6% of 130.39/145.90 rally), where dips should find solid ground.

Only break below daily Kijun-sen (140.85) would weaken near-term structure and risk test of pivotal 140.00 support zone (psychological / Fibo 38.2% of 130.39/145.90.

Res: 144.78; 145.00; 145.90; 146.76

Sup: 144.06; 143.54; 143.12; 145.55