Extended directionless mode ahead of MP’s vote on Brexit

Cable remains in directionless mode for the third straight day and awaiting fresh signals from today’s UK parliament meeting.

UK lawmakers are going to wrest control of Brexit and try to break the deadlock and push things forward, on today’s vote on a variety of possible Brexit outcomes.

The list of options is on the table, including all possible Brexit scenarios and the parliament will select the options to be voted.

These will be indicative votes and non-binding on the government, but may have impact on Brexit process.

The parliament will gather at 14:00GMT and debate is expected to end at 19:00 GMT.

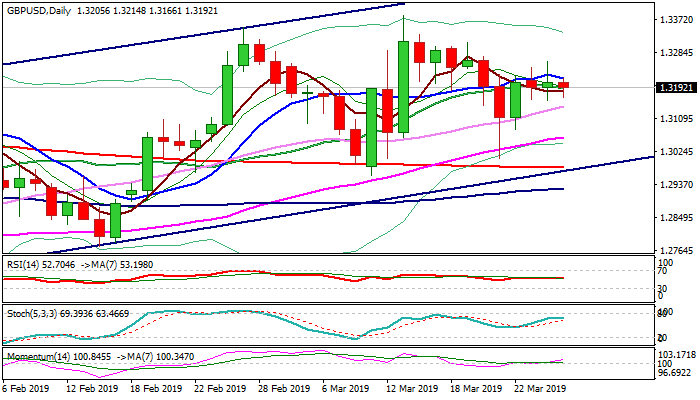

Near-term price action remains within familiar levels, capped by 10SMA, which limited the action of past two days while limited downside attempts remain well above rising 30SMA which marks lower pivot (currently at 1.3142).

Daily momentum remains firm but in conflict with stochastic and RSI in sideways mode, while MA’s remain in mixed setup and thick weekly cloud continues to weigh.

Initial bullish signal can be expected on sustained break above 10SMA, but confirmation requires lift above 1.3300 zone.

Conversely, close below 30SMA would weaken near-term structure and risk dip towards 55SMA (1.3062) that would unmask key supports at 1.2985/81 (trendline support / 200SMA).

Res: 1.3215; 1.3237; 1.3261; 1.3292

Sup: 1.3157; 1.3142; 1.3093; 1.3062