Kiwi may extend sharp fall sparked by surprise dovish shift from RBNZ

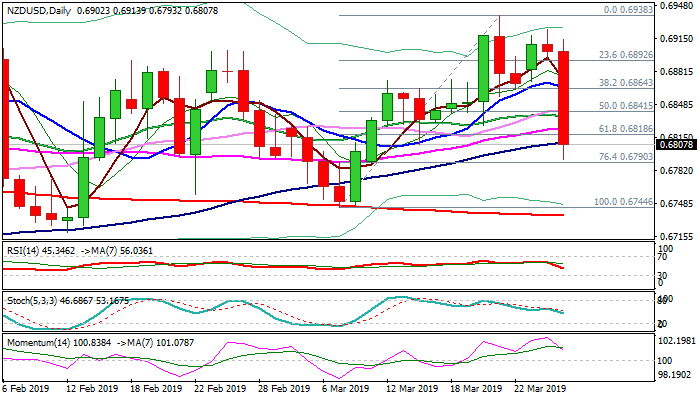

The Kiwi dollar attempts to consolidate at 0.6800 zone after overnight’s 1.6% fall, sparked by surprisingly dovish shift from the RBNZ.

The central bank kept its official cash rate unchanged at 1.75% in its today’s monetary policy meeting, but revised its outlook and said that the next move in interest rates would likely be down, catching traders off-guard.

Today’s slump broke through a number of technical supports (MA’s) and found temporary footstep at 0.6800 zone.

Bears also cracked strong supports at 0.6810/15 zone (100SMA / top of thick daily cloud / Fibo 61.8% of 0.6744/0.6938) and require daily close below to generate further strong negative signal.

Extension of today’s sharp fall could result in attack at key supports at 0.6744/36 (7 Mar trough / 200SMA).

Bears show no signs of fatigue despite strong acceleration, with daily indicators heading south and faster MA’s (5/10/20) turning lower that sets scope for further descend.

Broken MA’s now offer initial resistances at 0.6824 (55SMA) and 0.6837/42 (converged 20/30SMA’s).

Res: 0.6824; 0.6842; 0.6866; 0.6882

Sup: 0.6790; 0.6752; 0.6744; 0.6736