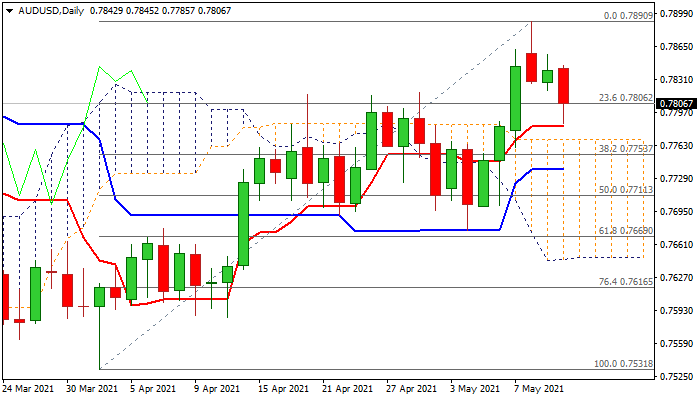

Extended pullback pressures the top of thick daily cloud

The Australian dollar dipped below 0.7800 handle on Wednesday after weaker than expected China bank loans data, with increased pressure coming from falling Asian equities.

Fresh weakness signals an extension of pullback from 0.7890 (May 10 high), where larger bulls stalled.

Bullish daily studies (rising positive momentum / MA’s in bullish setup) suggest limited correction before bulls regain traction.

Top of thick daily cloud (0.7769) and Fibo 38.2% of 0.7531/0.7890 (0.7753) offer solid supports which should contain dips and keep bulls intact for renewed attempt at 0.7794 target (Fibo 76.4% of 0.8007/0.7531).

Caution on break of these levels which could open way for deeper correction and expose supports at 0.7720 zone (converged 30/55/100DMA’s) and 0.7674 (May 4 trough).

Res: 0.7820; 0.7845; 0.7856; 0.7890

Sup: 0.7785; 0.7769; 0.7753; 0.7720