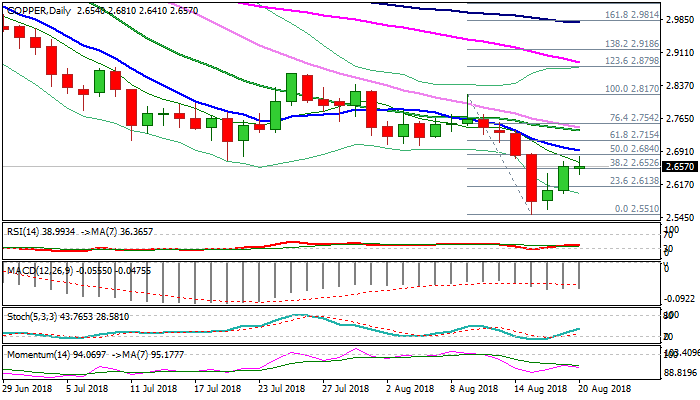

Extended recovery on eased tensions / strong demand, but overall picture remains bearish

Copper price hit new recovery high at $2.6810 on Monday, in extension of two-day rally from last week’s low at $2.5510 (the lowest since June 2017.

Easing trade tensions between the US and China, as well as signs of stronger demand, boosted metal’s price.

Bounce from $2.5510 low retraced so far nearly 50% of $2.8170/$2.5510 bear-leg, but holds for now below pivotal barrier, provided by falling 10SMA ($2.6931) break of which would generate fresh bullish signal for extended recovery.

On the other side, daily MA’s remain in firm bearish setup and momentum is weakening, which signals that broader bears are going to resume after limited corrective action.

Upticks should be ideally capped below $2.70 to keep bears intact for fresh push lower.

Last week’s low at $2.5510 marks initial pivot, guarding key points at $2.50 (psychological) and $2.4720/$2.4647 (May 2017 trough / Fibo 61.8% of larger $1.9360/$3.3200 ascend).

Res: 2.6930; 2.7000; 2.7154; 2.7375

Sup: 2.6410; 2.6000; 2.5510; 2.5000