Renewed downside risk after strong recovery rejection

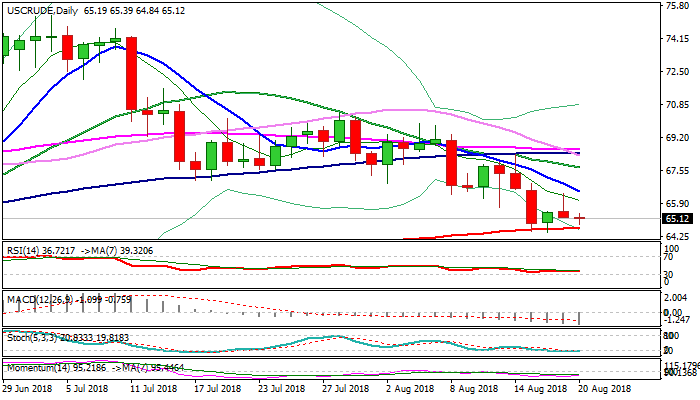

WTI oil price stands at the back foot at the beginning of the week, following fall after strong upside rejection on Friday, weighed by weak industrial data from China and concerns over emerging market economies, with focus on Turkey.

Strong bearish close last week, accompanied with last Friday’s shooting star pattern, maintain negative tone and keep the downside at risk for renewed attempt at key support (200SMA at $64.68) which repeatedly contained bearish attempts last week.

Firm break here would open way towards next key support at $63.58 (18 June trough).

Bearish daily techs support scenario, with falling 10SMA ($68649) expected to cap and maintain bearish pressure.

Res: 65.39; 66.49; 67.71; 68.35

Sup: 64.68; 63.58; 62.62; 60.00