Extended sideways mode eyes US jobs data for fresh direction signal

Quiet trading within 25-pips range suggests traders are on hold and awaiting stronger signals, with focus on today’s UK PMI’s (services and composite) US ADP private sector labor report and the most significant US non-farm payrolls on Friday.

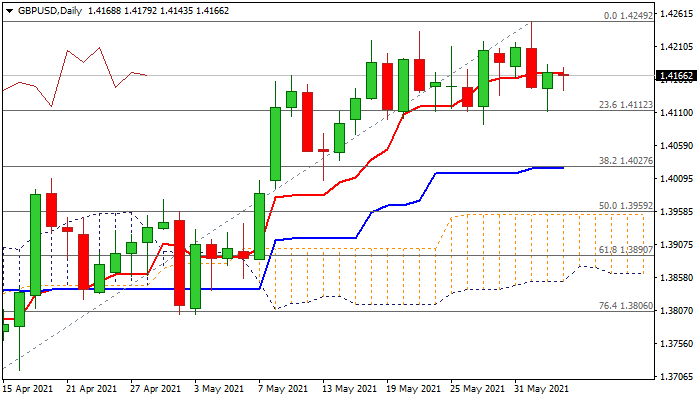

Today’s action remains biased lower despite Wednesday’s strong bounce as daily Tenkan-sen (1.4170) continues to cap.

Fading bullish momentum and south-heading stochastic on daily chart add to negative signals as next week’s daily cloud twist (1.3925) is expected to attract.

However, negative signals require verification on break of rising 20DMA and Fibo support at 1.4135/12 that would open way for deeper pullback.

Otherwise, extended sideways mode could be expected while the price remains within 1.4100/1.4250 range, with lift above daily Tenkan-sen to turn near-term bias bullish.

Res: 1.4170; 1.4183; 1.4219; 1.4249

Sup: 1.4135; 1.4112; 1.4100; 1.4055