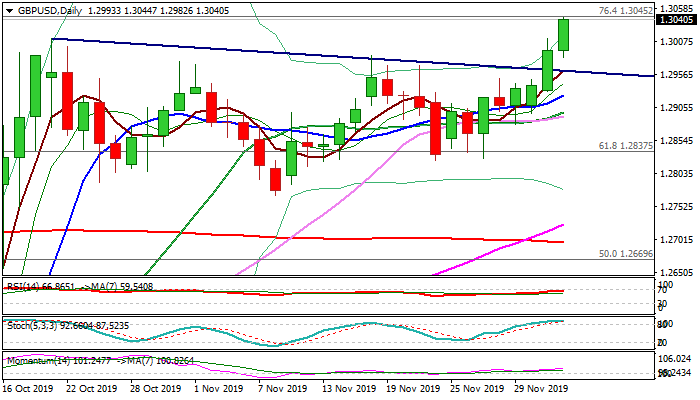

Final break of key 1.30 resistance zone signals bullish continuation

Cable rallied in early Wednesday’s trading and eventually broke above strong 1.30 zone barrier, to touch next target at 1.3045 (Fibo 76.4% of 1.3381/1.1958, reinforced by falling 100WMA), hitting the highest level in nearly seven months.

Positive sentiment is maintained by expectations for Tory’s majority on 12 Dec election that sparked fresh buying.

Final break above 1.30 zone signals an end of consolidative phase which started on 21 Oct, opening way for further advance, as rally from 1.1958 (2019 low) retraced the largest part of broader 1.3381/1.1958 fall.

Close above former high at 1.3012, which now acts as initial support, is needed to confirm break and signal bullish continuation.

Falling 200WMA (1.3102) marks next barrier, break of which would expose target at 1.3179 (3 May high, the lower top of 1.3381/1.1958 downtrend), with full retracement also expected to be in agenda if 1.3179 pivot gives way.

Strong bullish momentum on daily and weekly charts supports scenario, with price adjustments on overbought conditions, expected to provide better buying opportunities.

Broken bear-trendline (currently at 1.2963) should contain extended downticks and keep bulls in play.

Res: 1.3045; 1.3102; 1.3179; 1.3200

Sup: 1.3012; 1.3000; 1.2984; 1.2963