Firm bearish tone persists ahead of ECB

The Euro remains in red and moved lower in early European trading on Thursday, awaiting today’s key event, ECB interest rate decision.

Negative sentiment was soured further by weak PMI data from EU members, with focus on the strongest contraction of German manufacturing sector in seven years.

With negative signals coming from Europe and expectation for ECB’s 10bps rate cut today, near-term action remains firmly biased lower.

Markets expect the ECB to join establishing global easing trend and dovish statement that would open way for further easing in September.

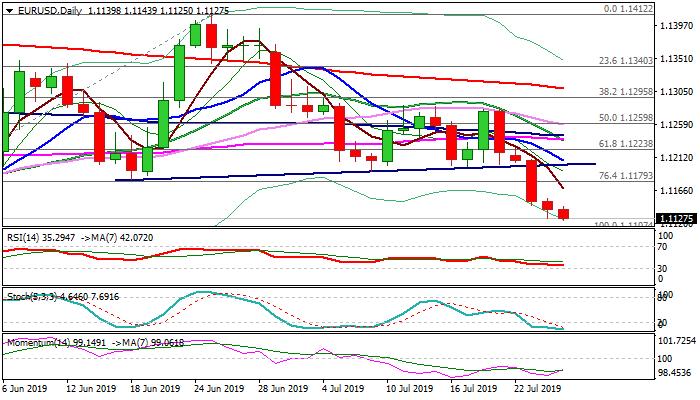

Fresh weakness probes below Wednesday’s low at 1.1126 and increasing risk of attacking key support at 1.1107 (2019).

Firm break below the base at 1.11 zone would spark fresh acceleration lower and expose psychological 1.10 support.

Bearish daily techs add to scenario, but deeply oversold stochastic and north-turning momentum signal that bears may show strong hesitation on approach to key 1.11 support zone.

Broken pivotal supports at 1.1180/1.1200 now mark solid resistances and expected to cap and keep bears in play.

Res: 1.1143; 1.1155; 1.1180; 1.1205

Sup: 1.1125; 1.1116; 1.1107; 1.1050