Fragile geopolitical situation and weakening techs could spark further fall of Turkish lira

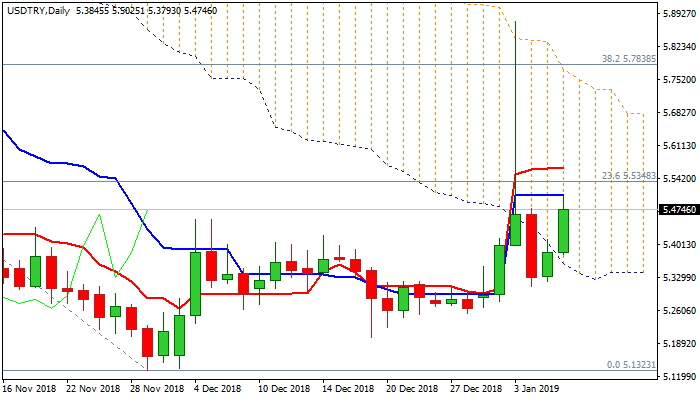

The USDTRY has stabilized and moves higher after last week’s strong rally to 5.8767 and subsequent quick pullback.

Fresh upside attempts extend into second day and penetrate daily cloud, on track for close within the cloud after the action in past three days repeatedly closed below the base of thick daily cloud.

Fresh advance is supported by strengthening momentum and daily 10/20/30 SMA turning north and being in bullish setup.

News that Turkey prepares for military action in Syria could have negative impact on lira if the situation deteriorates.

Larger picture shows that pullback from new all-time high was contained by rising 200SMA just above psychological 5.00 zone and attempts to form a base, which keeps the downside protected for now and shows scope for further recovery.

Close within daily close would offer initial bullish signal and expose key barriers at 5.7327 (100SMA); 5.7530 (daily cloud top) and 5.7838 (Fibo 38.2% of 6.8379/5.1323 descend).

Positive outlook could be expected while the price action remains above 200SMA (5.1677), with release of data from Turkey next week (labor; IP; current account) expected to provide more hints about the health of lira.

Res: 5.5025; 5.5348; 5.5653; 5.6484

Sup: 5.3806; 5.3453; 5.3151; 5.2539