WTI Oil stands at the front foot but key barriers at $50 zone are still intact

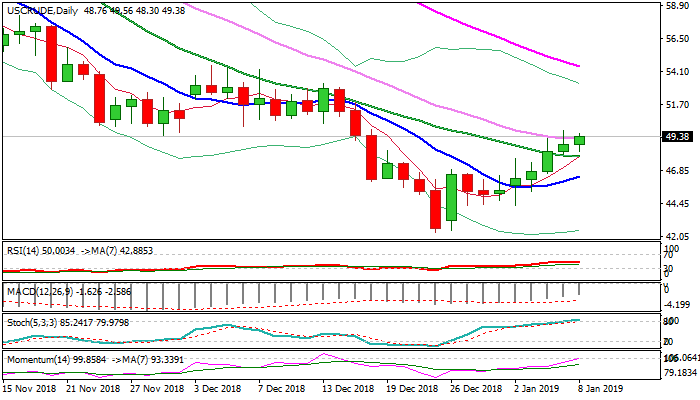

WTI oil maintains positive tone on Tuesday and probes again through falling 30SMA (currently at $49.19) which limited Monday’s action.

Oil price remains in green for the sixth straight day and eyes pivotal barriers at $49.89 (Fibo 61.8% of $54.54/$42.36) and psychological $50 barrier, supported by hopes for successful end US/China trade talks, news that Turkey resumed imports from Iran and optimism that production cut by major oil exporters would result in stabilizing oil market.

Improving daily techs (momentum is attempting into positive territory and 10/20/30SMA’s turning to bullish setup) support advance, which looks for bullish signal on sustained break above $50 zone.

On the other side, headwinds from fears of global slowdown which would reduce demand, could be limiting factor.

Broken 20SMA offers initial support at $47.90), followed by north-turning 10SMA ($46.47), loss of which would weaken near-term structure.

Release of US crude stocks reports (API today and EIA on Wednesday) would provide fresh signals.

Res: 49.89; 50.00; 50.90; 51.67

Sup: 48.45; 47.90; 46.47; 46.14