Fresh bears found a footstep above key support and eye US inflation data for signal

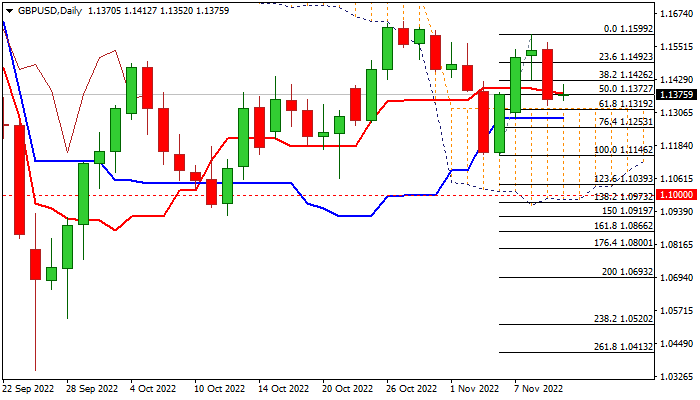

Cable is consolidating within a narrow range, following Wednesday’s 1.6% drop, which retraced over 50% of the recent 1.1146/1.1599 upleg.

Although a reversal pattern formed on a daily chart, fresh bears face strong headwinds from significant support at 1.1319 (top of thick daily cloud / Fibo 61.8%) which so far keeps the downside protected and prevent confirmation of reversal.

Daily studies are currently mixed, but expected to remain slightly biased higher while the action stays above the cloud, though lift and close above 10DMA (1.1427) is needed to revive bulls and extension above psychological 1.15 level to confirm.

Conversely, penetration of daily cloud and extension through daily Kijun-sen (1.1284) would add to bearish stance and risk deeper fall.

Traders look for US inflation data to get clearer signals, with October’s figure at / below forecast (8%) to deflate dollar and give fresh boost to sterling, while higher than expected result would add to the story of Fed’s continuous aggressive policy tightening, which is expected to be dollar supportive.

Res: 1.1426; 1.1500; 1.1567; 1.1599

Sup: 1.1333; 1.1319; 1.1284; 1.1253