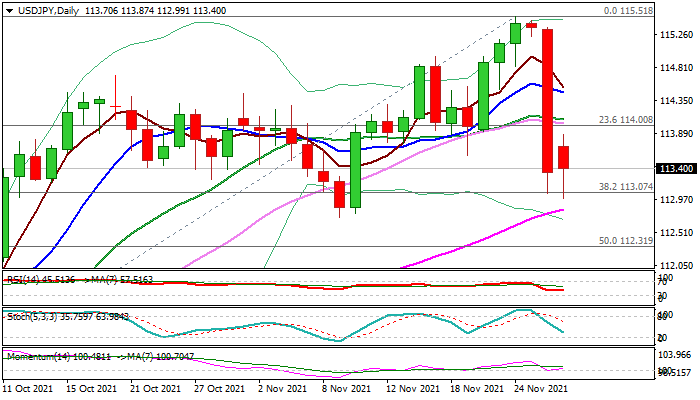

Fresh bears hold grip but face strong headwinds from key Fibo support

The USDJPY remains in red following Friday’s selloff (the pair was down 1.7%, the biggest daily fall since March 2020) driven by fears of new Omicron variant of coronavirus.

Friday’s massive bearish daily candle weighs heavily but bears continue to face headwinds from pivotal Fibo support at 113.07 (38.2% of 109.11/115.51 upleg) unable to break lower for the second day.

Persisting risk-off mode on Omicron uncertainty keeps the pair under pressure, although daily studies are mixed and lack clearer direction signal.

Bears need a firm break through 113.07 to generate initial signal of extension of pullback from 115.51 peak, with extension through 112.72 (Nov 9 trough) needed to confirm reversal signal.

Caution on repeated failure to break 113.07 Fibo support that would signal consolidation, with near-term bias to remain with bears while the action stays below 114 zone (broken Fibo 23.6% converged 30/20DMA’s).

Return and close above 114 would weaken bears and signal that pullback loses steam.

Res: 113.87; 114.08; 114.46; 114.69

Sup: 113.07; 112.72; 112.31; 112.07