Fresh bulls emerge after double downside rejection and pressure key Fibo barrier

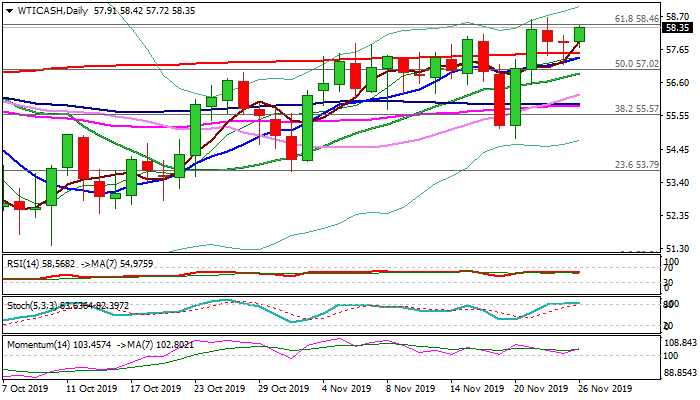

WTI oil regained traction on Tuesday and moved above $58 mark (session high $58.36) following Monday’s dip to $57.17 (contained above daily cloud top at $57.02) and subsequent bounce that left daily long-tailed Doji candle.

Oil prices were inflated by renewed optimism in long US/China trade talks as eventual deal would sideline fears of oversupply and boost demand.

Markets focus releases of US crude inventories for fresh signals, with The American Petroleum Institute report due later today and official government report (EIA) due on Wednesday.

Expectations for both reports are for further decline in US crude stocks that would additionally boost oil prices.

Double failure to clearly break below 200DMA ($57.54) resulted in fresh strength which pressure cracked key Fibo barrier at ($58.46), break of which would generate positive signal for extension of larger uptrend from $50.91 (3 Oct low).

Daily MA’s are in full bullish setup, with converging 10 and 200DMA’s on track to form golden cross and rising bullish momentum, support the advance, but overbought stochastic warns that bulls may show further hesitation at $58.46 barrier.

Res: 58.46; 58.67; 59.22; 59.70

Sup: 58.02; 57.54; 57.17; 56.89