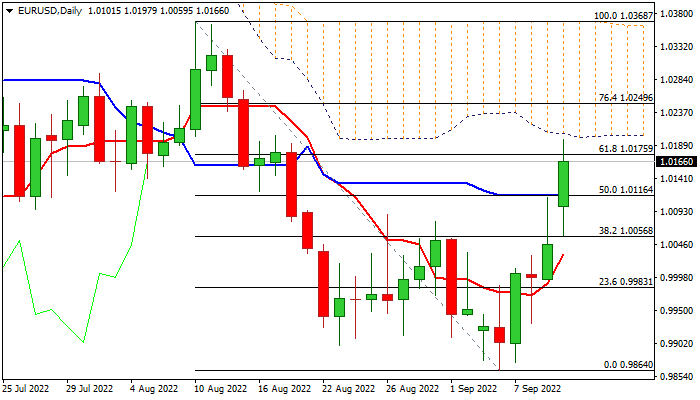

Fresh bulls may face increased headwinds from the base of thick daily cloud

The Euro advanced nearly 1% in early Monday, following a start of week’s trading by gap-higher opening, underpinned by renewed risk appetite.

Monday’s rally generated bullish signals on surge through pivotal Fibo levels at 1.0116/75 (50% and 61.8% retracement of 1.0368/0.9864 respectively) while fresh bulls currently pressure next key barrier at 1.0201 (base of thick daily cloud).

Rising bullish momentum on daily chart underpins the action, which may face increased headwinds from cloud base and possibly pause for consolidation.

Daily close above broken Fibo 50% barrier at 1.0116, reinforced by daily Kijun-sen, is required to keep bulls in play.

Firm break of cloud base would generate bullish signal for further recovery and possible test of key short-term resistances at 1.0368 (Aug 10 lower high / top of daily Ichimoku cloud).

Alternatively, return and close below 1.0116 would weaken near-term structure and signal that bulls run out of steam.

Res: 1.0175; 1.0201; 1.0249; 1.0268

Sup: 1.0116; 1.0082; 1.0056; 1.0023