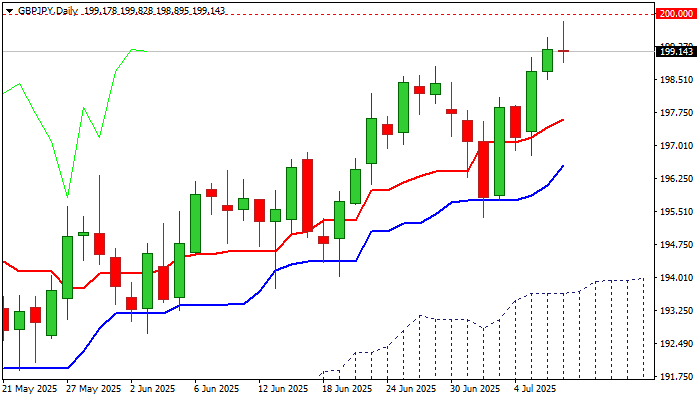

GBPJPY-bulls lose traction on approach to psychological 200 barrier

GBPJPY edged lower from new one-year high, as larger bulls started to lose traction on approach to psychological 200.00 barrier.

Japanese yen remains under increased pressure after trade talks with US have failed several times and the latest threat of 25% tariff on Japan’s imports from President Trump.

Export-oriented Japanese economy is one of top US trading partners and is likely to be hit more if they don’t reach a deal that would lead into scenario of high tariffs.

Bulls started to lose traction ahead of significant 200 barrier, with initial signals of reversal pattern already forming on hourly chart.

Overbought daily stochastic and fading momentum were likely among key triggers of partial profit-taking, with shooting star pattern developing on daily chart and generating initial signal of reversal.

Daily indicators show enough space for pullback, though dips might be limited and mark positioning for further advance, as the pair is in larger uptrend.

Pullback should ideally find ground above rising daily Tenkan-sen (197.59) with extended dips not to exceed rising daily Kijun-sen (196.54) to mark a healthy correction and keep larger bulls in play.

Caution on dip below Kijun-sen and particularly on extension below 195.35 (July 2 higher low) that would sideline bulls and signal potentially deeper correction.

Performance of British pound will be also closely watched as markets await release of May GDP data, which will show whether the Britain’s economy is entering recovery mode after it recorded the steepest fall in 1 ½ year in April.

Res: 199.82; 200.00; 200.52; 200.93

Sup: 198.80; 197.59; 196.54; 195.74