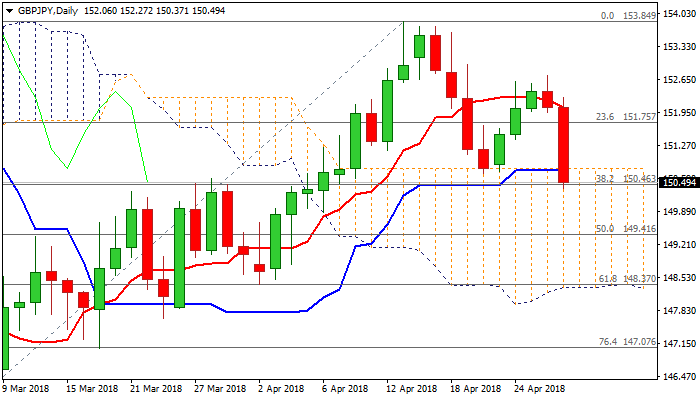

GBPJPY – close below cracked daily cloud top / Fibo 38.2% support would be strong bearish signal

The cross was sharply lower on Friday, driven lower by downbeat UK GDP data, losing 1% for the day so far.

Strong bearish acceleration penetrated thick daily cloud (spanned between 150.79 and 148.31), as cloud top contained previous attack at 20 Apr, where corrective pullback from 153.86 high stalled.

Fresh bears broke below former correction low at 150.69 and also cracked next pivot at 150.46 (Fibo 38.2% of 144.98/153.84 rally), looking for close below these supports to generate stronger bearish signal on completion of failure swing pattern on daily chart and break of pivotal Fibo support.

Psychological 150 support is coming in focus with extension towards 149.66 (55SMA) and 148.97 (200SMA), seen on break.

Daily MA’s are turning into bearish setup, while 14-d momentum is attempting into negative territory, maintaining bearish pressure.

Broken cloud top marks initial resistance at 150.79, reinforced by daily Kijun-sen and only weekly close above would sideline immediate downside risk.

Res: 150.79; 150.97; 151.43; 151.91

Sup: 150.37; 150.00; 149.66; 148.97