USDJPY – downside remains at risk after strong US GDP data showed mild impact on dollar

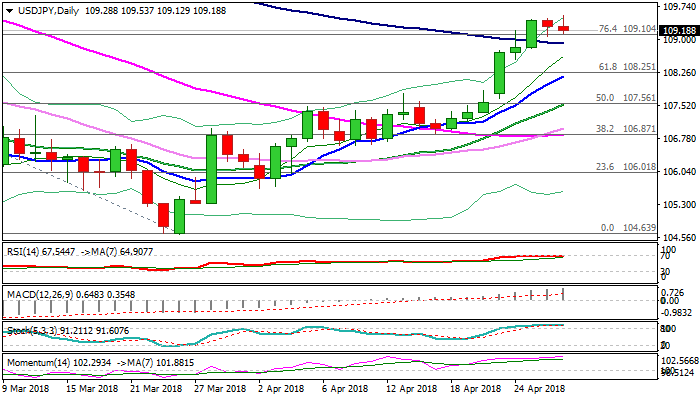

The pair spiked to new marginally higher 11-week high at 109.53 after US data on Friday, but gains proved to be short-lived.

Subsequent easing brought the price back to the mid-point of consolidation range (109.06/53).

Stronger than expected US Q1 GDP (2.3% vs 2.0% f/c) had little impact on dollar, which is taking a breather after last week’s strong acceleration higher.

Thursday’s Hanging Man was initial signal of reversal, which needs confirmation on Friday’s close below initial support at 108.90 (100SMA).

Daily RSI is reversing from overbought territory and supports the notion.

Bearish scenario on break and close below 100SMA would delay expected attack at 110.00/24 targets and signal extension of corrective pullback towards next pivotal support at 108.42 (Fibo 38.2% of 106.61/109.53 upleg).

Conversely, bullish close above 109.68 (Fibo 50% of 114.73/104.63) would neutralize growing downside risk and open way towards psychological 110.00 barrier and 200SMA (110.24).

Res: 109.53; 109.68; 110.00; 110.24

Sup: 109.10; 108.90; 108.42; 108.17