GBPUSD – bounce from post-data low sidelines immediate downside risk

Cable bounced from session low at 1.4160 (one-week low) and regained levels at 1.4140 zone, as M&A news offset negative impact from weak retail sales data, released earlier today.

Series of weaker than expected key UK data in last three days (wages; CPI, retail sales) put sterling under increased pressure and sparked pullback from new post-Brexit vote recovery high at 1.4376, posted on Tuesday.

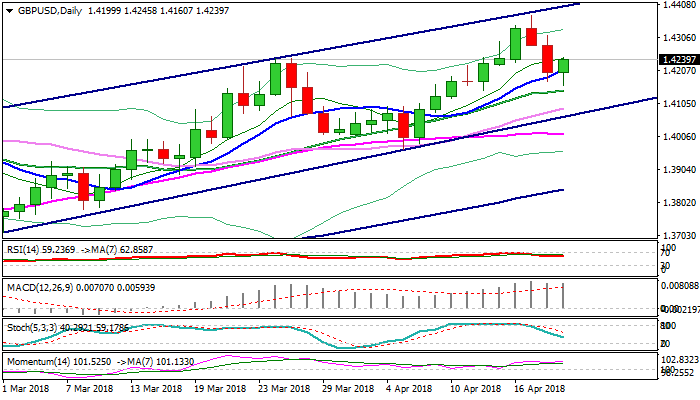

Two-day reversal found footstep at 1.4160 today and subsequent bounce returned well above cracked rising 10SMA and tested next pivot at 1.4243 (Fibo 38.2% of 1.4376/1.4160 bear-leg).

Fresh bulls need close above 10SMA as minimum requirement for bullish signal, while close above 1.4243 Fibo barrier would neutralize immediate downside threats and signal higher low formation.

The notion is supported by daily techs in full bullish mode and hopes that downbeat data wouldn’t impact expectations for BoE’s rate hike on their policy meeting next month.

Res: 1.4268; 1.4293; 1.4314; 1.4376

Sup: 1.4209; 1.4160; 1.4145; 1.4122