WTI OIL – bulls eye next target at $70

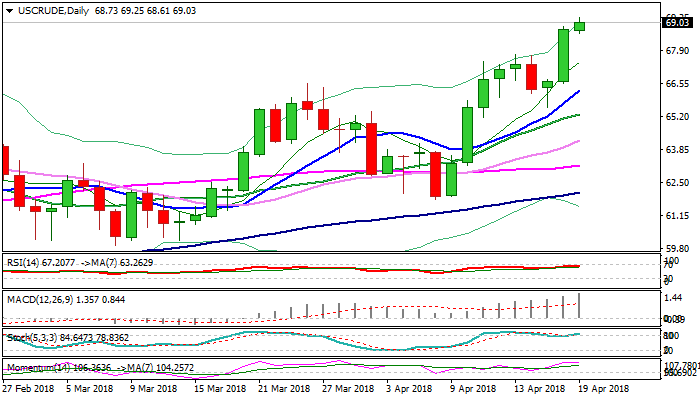

WTI oil price hit new over three-year high at $69.25 on Thursday, in extension of previous day’s strong rally.

Strong bullish sentiment returned to play after brief $67.74/$65.55 correction, as weekly crude stocks fell more than expected (1.07 million barrels vs 0.5 million barrels draw forecasted), EIA report showed on Wednesday and Saudi Arabia continues to push for production cut, in order to further tighten oil market.

OPEC and Russia, key world oil producers maintain their efforts for extended output cut to neutralize negative impact from oversupply and eye $80 per barrels as next target, signaling that oil price could extend even higher.

Bulls approach initial target at $70 and could extend in the short-term towards $76.35 (Fibo 61.8% of 107.45/$26.04 fall) on break higher.

Bullish daily studies add to positive sentiment, however, overbought slow stochastic warns of hesitation on approach to $70 target.

Last week’s former high at $67.74 marks initial support ahead of previous top at $66.64 (25 Jan), where extended dips should find ground.

Res: 69.25; 70.00; 71.00; 71.86

Sup: 68.61; 67.74; 66.64; 66.40