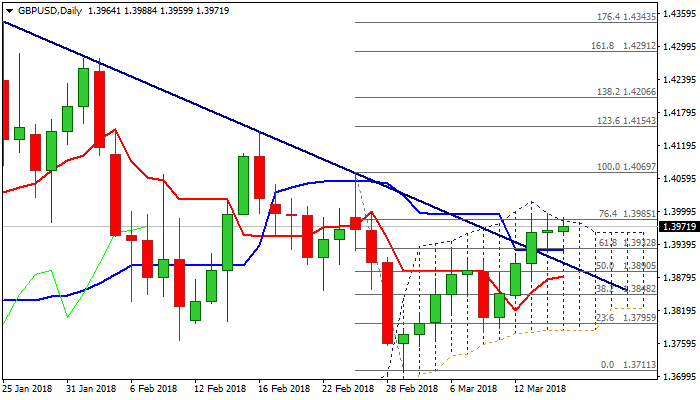

GBPUSD – bullish bias but daily cloud top continues to limit upside attempts

Cable stands at the front foot on Thursday and pressures daily cloud top, after attempts in past two days failed here and Wednesday’s action ended in Doji candle, signaling indecision

Bulls may show signs of stall on repeated failure to break higher, as momentum studies are neutral and overbought slow stochastic warns of pullback.

Strong offers in 1.40 zone continue to frustrate bulls which need clear break higher to signal continuation of recovery phase from 1.3711 (01 Mar low).

Bullish scenario sees extension towards 1.4070 (26 Feb high) and pivotal 1.4103 barrier (Fibo 61.8% of 1.4344/1.3711) on firm break above 1.40.

Repeated close below cloud top would be bearish signal which needs confirmation on extension below 1.3920/06 pivots (30SMA / broken bear-trendline off 1.4345 peak.

Res: 1.4000; 1.4069; 1.4103; 1.4144

Sup: 1.3960; 1.3920; 1.3906; 1.3880