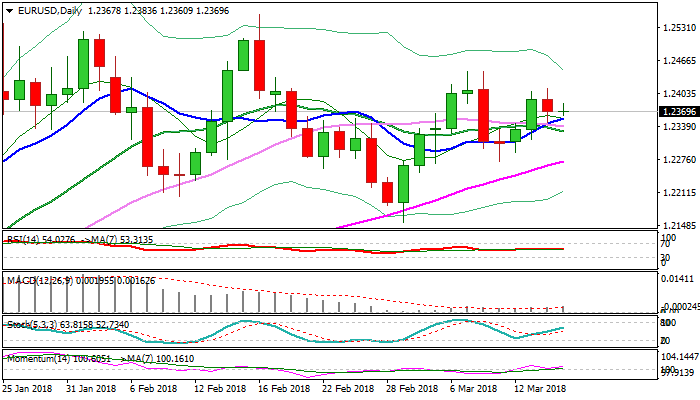

EURUSD – in sideways mode but bullish bias above 10SMA

The Euro remains in sideways mode and within tight range at the beginning of European session, following quiet trading in Asia.

Wednesday’s close in red after repeated failure to clear 1.24 barrier weighs, but dips so far hold above pivotal supports at 1.2355 (converged daily Tenkan-sen / Kijun-sen in attempts to form bullish cross / 10SMA).

Hopes for fresh upside are expected to remain in play while the latter supports hold, as MA’s are in bullish setup and momentum heads north in positive territory, keeping in play near-term bullish bias.

Overall action is underpinned by rising daily cloud, with cloud top marking next pivotal support at 1.2297.

Bulls need close above cracked 1.2400 barrier (Fibo 61.8% of 1.2555/1.2154 descend) to signal further recovery towards 1.2446 (07/08 Mar double top) and 1.2460 (Fibo 76.4%), with extension towards psychological 1.2500 barrier, seen on stronger acceleration.

The notion is supported by weaker dollar after US retail sales miss and persisting trade war fears.

Bearish scenario requires break of 10SMA (1.2355) and 20SMA (1.2330) as initial bearish signals to expose key supports at 1.2297 (daily cloud top) and 1.2272 (09 Mar low / rising 55SMA).

Res: 1.2383; 1.2412; 1.2446; 1.2460

Sup: 1.2355; 1.2330; 1.2297; 1.2272