USDTRY – strong rally broke above daily cloud; all-time high coming in focus

The Turkish lira stays under strong pressure against dollar, falling for the third consecutive day. Increasing worries about Turkish economy as current account deficit widened strongly in recent months, double-digit inflation and conflict in Syria, prompted investors to exit lira positions.

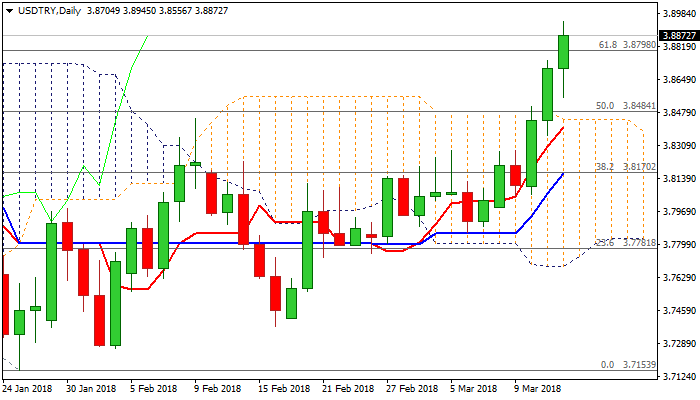

Broader correction from record high at 3.9814, posted on 22 Nov 2017, has bottomed at 3.7250 zone and subsequent recovery rally generated strong bullish signals on Tuesday’s break above thick daily cloud (cloud top lies at 3.8441) and today’s break above 3.8798 pivot (Fibo 61.8% of 3.9814/3.7153 pullback) generated signal that corrective phase might be over.

Today’s extension of strong three-day rally approached target at 3.8960 (14 Dec high / lower top of pullback from 3.9814), break of which would open way towards all-time high at 3.9814.

Firmly bullish setup of daily techs underpins negative sentiment around lira, however, rally could be interrupted for corrective action on overbought conditions.

Corrective dips could offer better buying opportunities for final push towards 3.9814 high and psychological 4.00 barrier which already came in focus.

Broken daily cloud top now acts as solid support which is expected to contain dips.

Res: 3.8960; 3.9186; 3.9450; 3.9726

Sup: 3.8798; 3.8556; 3.8481; 3.8170