GBPUSD – bulls regain traction after Monday’s pause

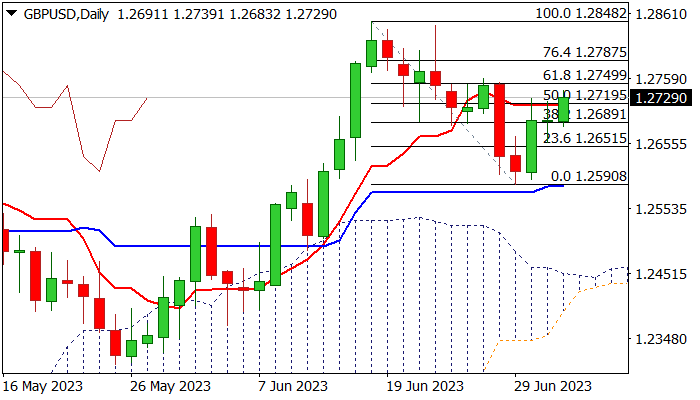

Cable rises further on Tuesday, signaling likely bullish continuation after Monday’s long-legged Doji warned of indecision and possible recovery stall.

Fresh bulls cracked pivotal barrier at 1.2719 (daily Tenkan-sen / 50% retracement of 1.2848/1.2590, generating initial bullish signal, which will still require confirmation on close above this level.

Bulls hold grip on daily chart as momentum indicator is in positive territory and Tenkan-sen / Kijun-sen returned to bullish configuration, focusing targets at 1.2750/87 (Fibo 61.8% and 76.4% respectively), with stronger acceleration to possibly challenge key barriers at 1.2848 (2023 high of June 16) and 1.2881 (200WMA).

Caution is still required as next week’s daily cloud twist (1.2460) could be magnetic, especially if recovery fails to clear 1.2719 pivot.

Markets look for more signals from Wednesday’s release of UK PMI data and Fed’s minutes, ahead of key US labor reports for June, due on Thursday (ADP) and Friday (NFP).

Res: 1.2750; 1.2787; 1.2842; 1.2881

Sup: 1.2689; 1.2651; 1.2590; 1.2547