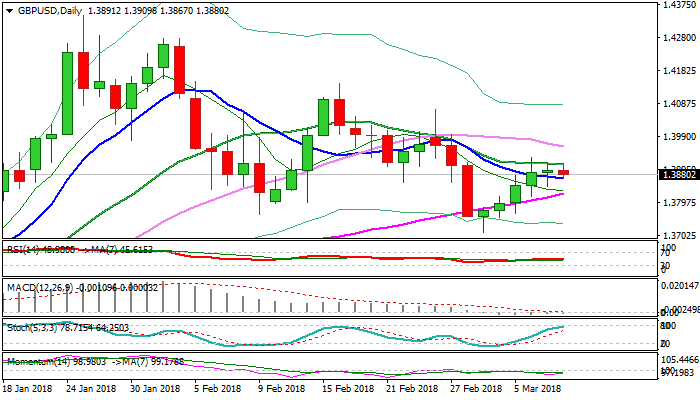

GBPUSD – downside risk to remain I play while 20SMA caps

Cable shows hesitation ahead daily cloud top (1.3968) which marks key near-term barrier, as four-day rally stalled just under cloud top on Tuesday and Wednesday’s action ended in Doji, capped by 20SMA.

Trading in Asian / early European session is entrenched within tight range and remains capped by 20SMA (1.3910), generating negative signal.

Weak momentum studies on daily chart support scenario of fresh weakness on repeated upside failure, along with slow stochastic which approaches overbought territory.

Initial support at 1.3866 (10SMA) is under pressure and break lower would generate initial bearish signal for extension towards next pivot at 1.3823 (55SMA) and key supports at 1.3794/77 (Fibo 61.8% of 1.3711/1.3929 / daily cloud base).

Bullish scenario needs firm break above 20SMA to challenge daily cloud top and generate positive signal on break.

Res: 1.3910; 1.3929; 1.3960; 1.3996

Sup: 1.3866; 1.3823; 1.3794; 1.3777