USDJPY – directionless mode expected ahead of Friday’s key releases

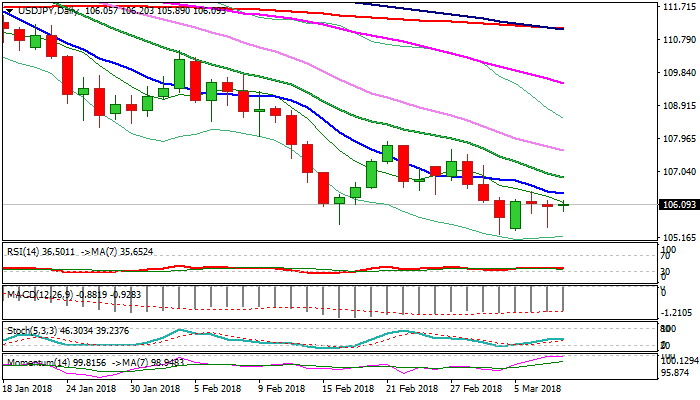

The pair trades in extended directionless mode on Thursday, following strong rejections on both sides in past two days.

Recovery attempts were capped by Fibo barrier at 106.44 on Tuesday, while bearish acceleration was strongly rejected on Wednesday, leaving long-tailed Doji and sidelining immediate downside risk.

The pair is expected to remain within congestion, ahead key events on Friday, BoJ interest rate decision and US NFP data, which could provide fresh direction signals.

The upside is expected to remain limited by 10SMA / Fibo 23.6% of 110.28/105.24 at 106.44, with stronger upticks to be capped by falling 20SMA at 106.85.

Overall picture remains bearish and favors fresh weakness after consolidation, with Friday’s releases expected to be the main driver.

Res: 106.22; 106.44; 106.85; 107.20

Sup: 106.20; 105.45; 105.24; 105.00