GBPUSD – extended recovery hit one-week high as fundamentals continue to support

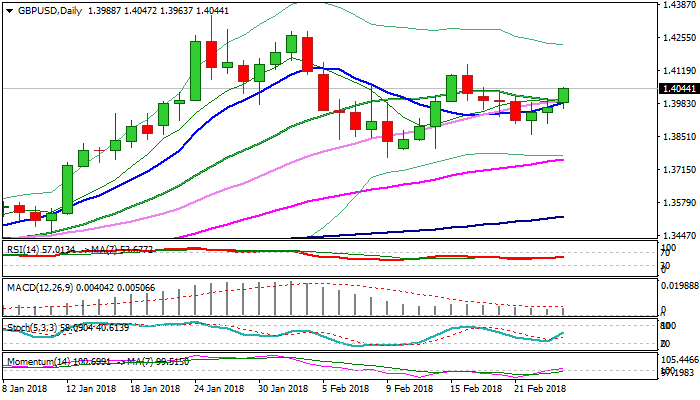

Cable maintains bullish tone at the beginning of the week and rallied to new one-week high at 1.4046 after taking out psychological 1.40 barrier.

Strong bullish acceleration in early Monday’s trading improved technical picture as the pair broke above 1.4034 pivot (Fibo 61.8% of 1.4144/1.3856 bear-leg), while daily MA’s (10;20;30) turned in bullish setup and 14-d momentum broke into positive territory, supporting the advance.

Bulls pressure barrier at 1.4054 (daily Kijun-sen) and eye 1.4076 (Fibo 76.4%), break of which would open way towards key near-term resistance at 1.4144 (16 Feb high).

Broken 1.40 hurdle now offers initial support ahead of 1.3972/66 (broken daily Tenkan-sen / broken Fibo 38.2% of 1.4144/1.3856 bear-leg) which should keep the downside protected.

Fundamentals are also working in favor of sterling as BoE’s deputy governor Ramsden showed hawkish steer towards possible rate hike in May, in his newspaper interview on Sunday.

Hopes for softer Brexit also support pound, as opposition Labour Party backs custom union with EU.

Res: 1.4054; 1.4076; 1.4100; 1.4144

Sup: 1.4034; 1.4000; 1.3966; 1.3904