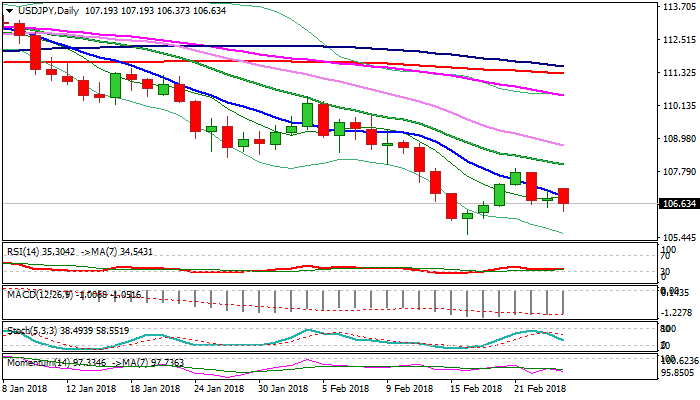

USDJPY – bears continue to focus 105.54 target

The pair holds in red at the beginning of European session and cracked pivotal support at 106.44 (Fibo 61.8% of 105.54/107.90 upleg), after short-lived probe above 107 barrier in early Asian trading.

Fresh weakness probes below the base of thick 4-hr cloud (106.54), weighed by thickening falling hourly cloud (spanned between 106.95 and 107.24) and falling 10SMA (106.90).

Bears need close below Fibo support at 106.44 to confirm continuation of bear-leg from 107.90 (last week’s strong upside rejection) towards key support at 105.54 (16 Feb low, reinforced by 20-d Bollinger band), as daily studies in full bearish setup support the notion.

Immediate bears could be delayed on bounce and close above falling 10SMA, but stronger bullish signal could be expected on sustained lift above 108 resistance zone (last week’s rejection, reinforced by falling 20SMA).

Res: 106.90; 107.00; 107.24; 107.66

Sup: 106.37; 106.10; 105.54; 105.00