GBPUSD – recovery is facing headwinds at pivotal Fibo resistance

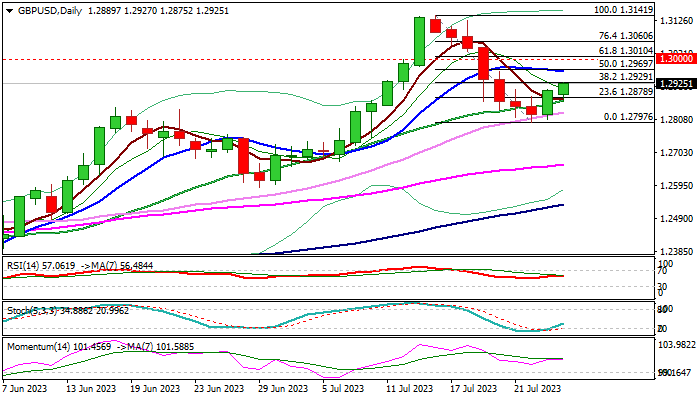

Recovery from 1.2800 zone extends into second straight day, adding to initial positive signal from Tuesday’s bullish engulfing, but bulls face headwinds at pivotal Fibo barrier at 1.2929 (38.2% retracement of 1.3141/1.2797 bear-leg).

Firm break here is needed to signal a higher low at 1.2800 zone (low of corrective pullback from 2023 high at 1.3141) and open way for further recovery, with lift through next key levels at 1.2969 (50% retracement / 10DMA) and 1.3000 (psychological) to confirm an end of 1.3141/1.2797 corrective phase.

Daily techs are overall bullish (14-momentum is well in the positive / north-heading stochastic emerged from oversold territory) though break of 10DMA still needed to verify bullish stance.

Markets await Fed Chair Powell’s post-rate decision comments, to get more clues about central bank’s next steps and shift focus to next week’s BOE policy meeting.

Economist expect the central bank to raise interest rates, with majority pointing to 25 basis points hike, with surprise decision for 50 basis points hike to provide stronger support to sterling.

Res: 1.2929; 1.2969; 1.3000; 1.3060

Sup: 1.2878; 1.2829; 1.2797; 1.2750