Gold keeps firm tone as traders await fresh signals from Fed

Gold price rises for the second consecutive day, driven by weaker dollar, but traders remain cautious ahead of Fed’s rate decision at the end of two-day policy meeting.

Markets widely expect the central bank to deliver another 25 basis points hike after pausing last month, with prevailing view that interest rates are close to their peak and seeing possibility for one more hike this year, before ending tightening cycle.

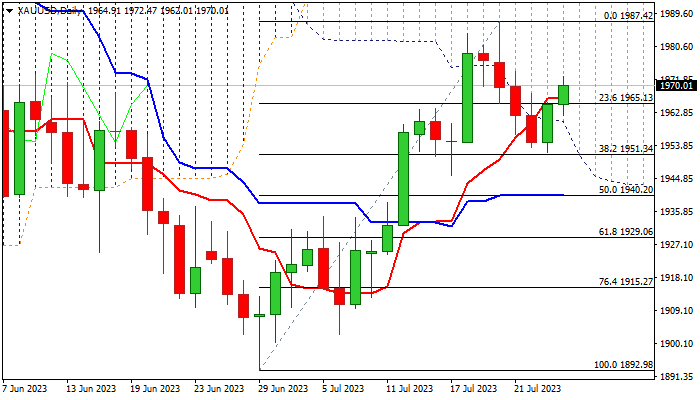

Gold would receive fresh support on Fed’s dovish stance and may challenge again the ceiling of two-month range ($1986), which guards psychological $2000 barrier, reinforced by the top of daily Ichimoku cloud.

Near-term action penetrated thick daily cloud again and repeated close within the cloud to add to positive signals, with bullish bias to remain intact while daily cloud base ($1960) holds.

Res: 1972; 1987; 2000; 2008

Sup: 1966; 1960; 1951; 1940