GBPUSD stays afloat above 1.2600 but the downside is still at risk

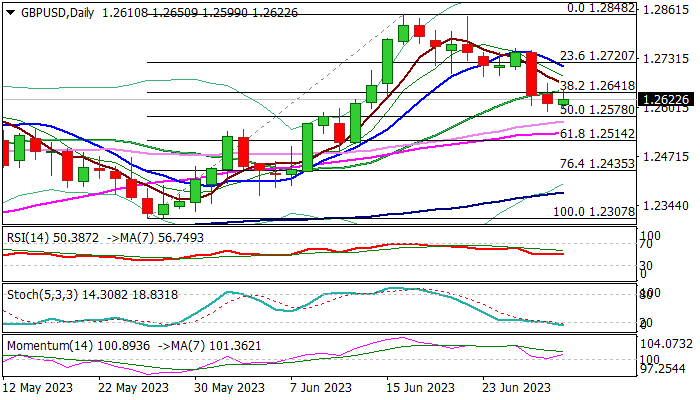

Cable dipped after weak UK data on Friday (current account gap widened and the economy barely grew in Q1) but so far staying afloat above 1.2600 handle (round-figure / Fibo 23.6% of 1.1802/1.2842 rally), which also contained drop on Thursday.

Initial signal of basing is developing on daily chart, supported by fresh bullish momentum and oversold stochastic, though scenario will require more action (bounce and close above 10DMA at 1.2711) to be verified.

On the other hand, the downside is expected to remain vulnerable as dollar continues to strengthen, supported by recent solid US data which contribute to Fed’s hawkish stance and opens way for further rate hikes, while Thursday’s close below pivotal Fibo support at 1.2641 (38.2% of 1.2307/1.2848 upleg) generated initial bearish signal.

We will focus on reaction at 1.2600 zone, with break here and a nearby Daily Kijun-sen (1.2578) to weaken near-term structure and risk deeper drop, while floating above 1.2600 level would keep bears on hold but will require further signals to start changing near-term direction.

Res: 1.2665; 1.2684; 1.2711; 1.2759

Sup: 1.2600; 1.2578; 1.2535; 1.2514