Gold accelerates higher sharply as dollar loses ground

Gold price was sharply up on Tuesday, accelerating on start of the vote in the US midterm election.

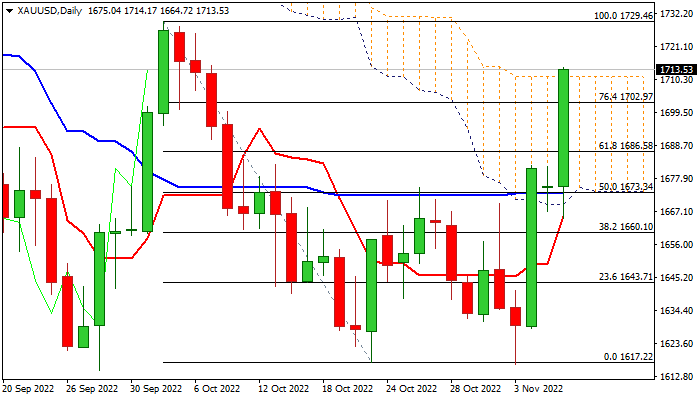

Bulls regained traction after strong rally that started last Friday, paused for consolidation on Monday and broke through pivotal barriers at $1700/$1702 (psychological / Fibo 76.4% of $1729/$1616) and cracked next key obstacle at $1711 (top of thick daily cloud).

Weaker dollar on hopes that Fed would soften its aggressive policy tightening, following October’s US labor report, expectations that inflation would ease further (report is due on Thursday), boosts yellow metal’s appeal, pushing the price to the highest in one month.

Close above $1700 zone to generate positive signal, while lift above cloud top would add to positive sentiment and confirm strong bullish stance.

However, conditions on daily chart are overbought and suggest that traders may collect some profits and slow strong bullish acceleration in coming sessions, with dip-buying seen as currently favored scenario.

Res: 1717; 1725; 1729; 1735

Sup: 1711; 1700; 1686; 1679