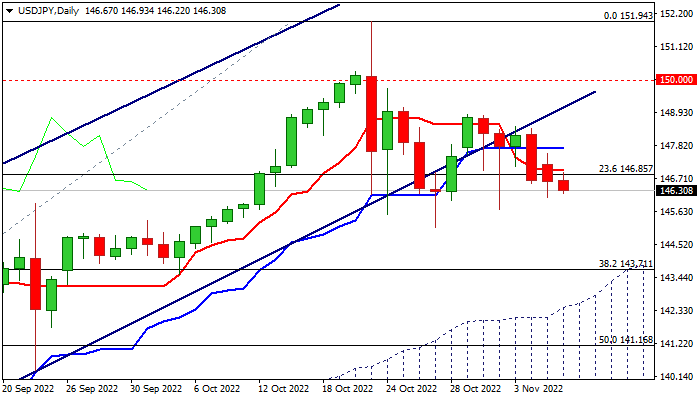

Loss of key Fibo support to spark stronger bearish acceleration

The pair holds in red for the third straight day, with risk of further weakening seen on confirmation of initial bearish signal on Monday’s repeated close below Fibo support at 146.85 (23.6% of 130.39/151.94 upleg).

Rising negative momentum on daily chart and Tenkan-sen / Kijun-se turning to bearish configuration, pressure dollar and add to downside risk.

Bears look for attack at first pivot at 145.10 (Oct 27 trough), break of which would generate fresh bearish signal on formation of daily failure swing, though bears would look for confirmation on extension and break through key Fibo level at 143.71 (38.2% of 130.39/151.94) to signal reversal and open way for extension towards daily cloud top (142.55) and 141.16 (50% retracement).

Near-term action should stay below daily Tenkan-sen (146.97) to keep bears in play.

Res: 146.97; 147.73; 148.36; 148.90

Sup: 145.67; 145.10; 143.71; 142.55