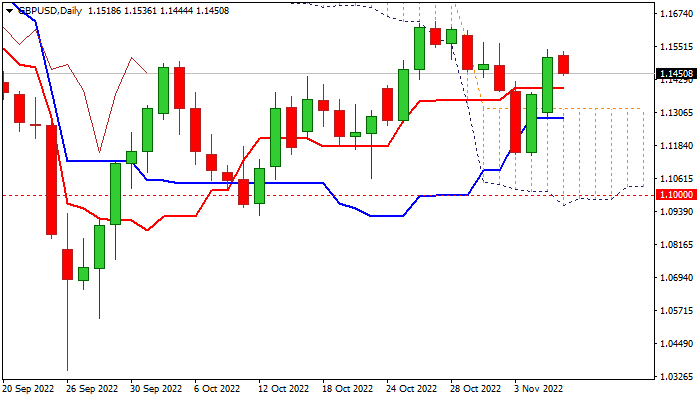

Near-term action to keep bullish bias while holding above daily Tenkan-sen

Cable eases in early Tuesday after strong two-day rally, as bulls take a breather on firmer dollar, so far unable to register a clear break above cracked 1.15 barrier.

Fundamentals remain weak as red-hot inflation bites, raising cost of living and hurting consumer spending that results in gloomy short-term outlook, though expectations of a tough budget boost confidence and partially offset negative signals.

Daily techs, on the other side, are so far bullishly aligned and supportive, but the price action needs to hold above daily Tenkan-sen (1.1395) to maintain bullish bias for renewed attack at 1.15 pivot and possible extension towards key barrier at 1.1645 (Oct 27 high).

Caution on break of daily Tenkan-sen, which would weaken near-term structure and expose key supports at 1.1321 and 1.1284 (daily cloud top / daily Kijun-sen).

Res: 1.1500; 1.1541; 1.1566; 1.1645

Sup: 1.1395; 1.1337; 1.1284; 1.1264