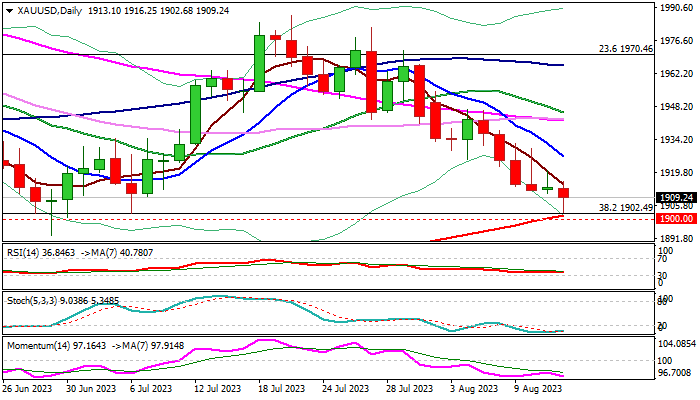

GOLD – bears pressure key supports at $1900 zone

Gold price fell to new 5-week low on Monday, pressured by rising dollar and hawkish view over US interest rates in the near future, following mixed US inflation numbers in July.

The metal regained bearish tone after larger downtrend off July 20 peak took a breather on Friday (Doji candle), pressuring key supports at $1900 zone (200DMA / psychological), where the action was strongly rejected on June 29 and left a bear-trap.

Bears already show hesitation as support is strong and stochastic on daily chart is deeply oversold, but consolidation is likely to be narrow, with upticks to stay capped under the base of thick daily cloud ($1926) to keep bears intact and offer better levels to re-join bearish market.

Firm break of pivotal $1900 zone (reinforced by Fibo 38.2% of $1614/$2080 rally) would generate strong reversal signal and open way for deeper correction of $1614/$2080, with risk of testing 50% retracement ($1847) and deeper drop towards $1800 zone, not ruled out on stronger acceleration.

Minutes of Fed’s July policy meeting will be the key event for the yellow metal this week, as traders expect more signals about the central bank’s near-term action on interest rates, with prevailing expectations to keep hawkish stance.

Only strong bounce into daily cloud would harm bearish outlook and signal another rejection at $1900 zone.

Res: 1909; 1926; 1942; 1946

Sup: 1900; 1892; 1847; 1804