Gold – deeper drop to be expected on firm break of key $1900 support zone

Gold price edged higher in European trading on Thursday, after hitting five-month low ($1889) in Asia.

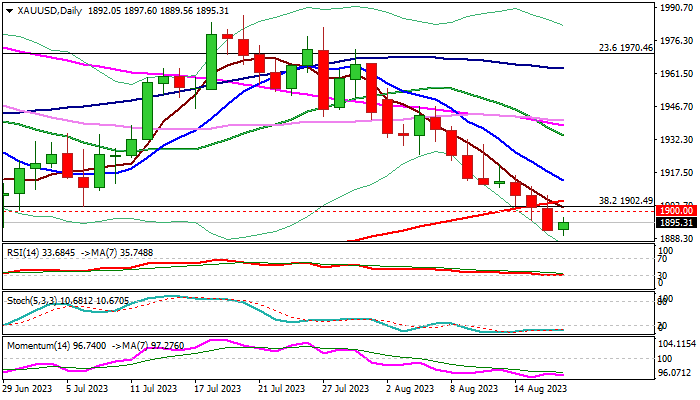

Wednesday’s close below key supports at $1900 zone (200DMA – $1905; Fibo 38.2% of $1614/$2080 – 1902; psychological – $1900 and former low of June 29 – $1892) generated strong bearish signal.

Signal needs to be verified by sustained break below these supports, which will also complete a failure swing pattern on daily chart and add to bearish outlook.

Stronger dollar on overall hawkish Fed, as well as growing concerns about China’s economic growth, particularly on developing crisis in property sector, prompt traders into dollar and continue to pressure the yellow metal.

Meanwhile, bears may take a breather and consolidate, as daily studies are oversold, with the action expected to stay capped under 200DMA to keep bears intact for extension towards targets at $1858/$1847 (Mar 6 high / 50% retracement of $1614/$2080).

Caution on bounce above 200DMA which would generate initial signal of a false break lower, with acceleration above falling 10DMA ($1914) to weaken bearish structure and risk stronger rebound.

Res: 1900; 1905; 1914; 1926

Sup: 1889; 1858; 1847; 1804