Aussie dollar hit new multi-month low, but bears faced strong headwinds

Australian dollar spiked to the lowest since early November on Wednesday, hit by downbeat Australia’s labor data (employment fell by 14.6K in July after 31.6K increase in June and well below forecast for 15K increase, while unemployment rose to 3.7% from 3.5% previous months and overshot consensus at 3.6%) adding to already weakened risk sentiment on concerns about China’s economic recovery.

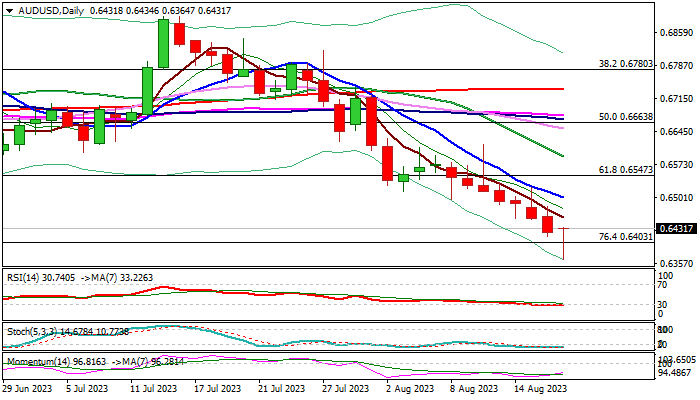

Fresh bears broke through Fibo support at 0.6403 (76.4% of 0.6170/0.7157) and hit new multi-month low at 0.6364, but dip was short-lived as price quickly bounced to the session high, as daily studies are stretched.

Price adjustment is likely to precede fresh push lower and offer better selling opportunities while the price stays below falling 10DMA (0.6501).

Firm break of cracked Fibo support at 0.6403 would signal continuation of larger downtrend and risk test of 2022 low at 0.6170.

On the other hand, bears may lose traction on lift and close above 10DMA (0.6501), which would also generate initial signal of bear-trap and allow for stronger recovery.

Res: 0.6458; 0.6501; 0.6521; 0.6547

Sup: 0.6403; 0.6364; 0.6272; 0.6170