Cable eases on downbeat UK data, but needs to clear key supports to signal reversal

GBPUSD dips on Friday morning following much bigger than expected drop in UK retail sales, which fell by 3.2% in July after 1.6% drop in June and strongly beating forecast for 2.2% fall.

Traders sold pound after downbeat data further boosted fears about the negative impact on the economy, already hit by high inflation and 14 consecutive interest rate increases, which push the borrowing cost to 5.25%.

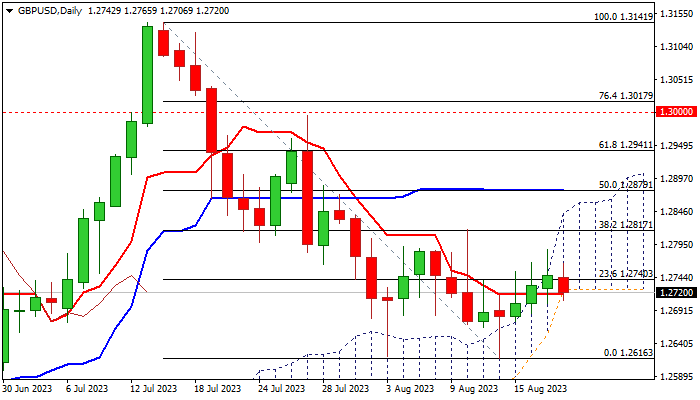

Fresh weakness cracked pivotal supports at 1.2724/17 zone (daily cloud base / Fibo 38.2% of 1.2616/1.2787 recovery leg / daily Tenkan-sen) but needs to register close below these levels to confirm bearish signal.

Although recent weakness was contained by daily Ichimoku cloud and subsequent recovery was moving along with rising cloud top, long upper shadows of daily candles in past three days, warned of strong offers and persisting risk of recovery stall, as near-term bulls likely got trapped above 20DMA (1.2770).

Daily studies are bearishly aligned as momentum indicator remains in the negative territory and RSI is heading south, with sustained break below the base of rising and thickening daily cloud, to boost reversal signal and allow for deeper drop.

Conversely, failure to clearly break below cloud base would reduce immediate downside risk and likely keep near-term action in a sideways mode, while under pivotal barriers at 1.2817/18 (Fibo 38.2% of 1.3141/1.2616 fall / Aug 10 spike high.

Res: 1.2765; 1.2787; 1.2817; 1.2879

Sup: 1.2701; 1.2681; 1.2656; 1.2616