Gold falls sharply on news from China, NFP in focus

Gold price was sharply down during European trading on Friday, as news that China’s central bank paused gold purchases last month after buying the yellow metal for 18 straight months.

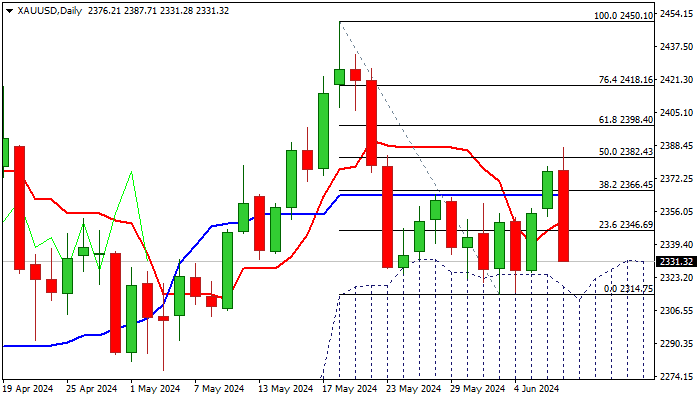

The price pulled back from new three-week high ($2387), losing around 1.7% of its value in European session.

Fresh weakness neutralized initial positive signal, generated on Thursday’s close above the recent range top, as well as pivotal barriers at $2363/66 (daily Kijun-sen / Fibo 38.2% of $2450/$2314 bear-leg) and shifted near-term focus to the downside.

Key near-term support (top of thick daily Ichimoku cloud, which contained a number of attacks during past two weeks) comes under pressure again, with overall still negative picture on daily chart (strong bearish momentum / south-heading RSI) increasing risk of eventual breach to the downside after recovery stall and subsequent weakness.

US jobs report is expected to provide strong direction signal and to be another key driver of gold’s price today.

Res: 2347; 2362; 2387; 2398

Sup: 2312; 2300; 2277; 2222