USDCHF at a multi-week low and cracking key supports ahead US jobs data

USDCHF stands at the back foot and hit new multi-week low early Friday, as markets await release of US jobs report for May.

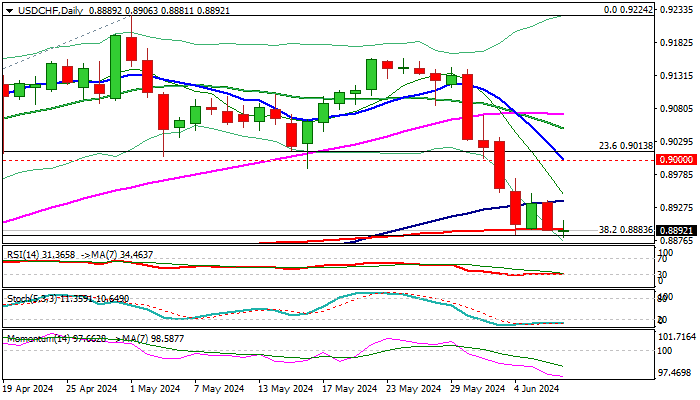

Recent bear-leg from 0.9158 (May 24 lower top) has found solid support at 0.8893/83 zone (200DMA / Fibo 38.2% of 0.8332/0.9224 rally) which contained several attacks in past few sessions, keeping the price in consolidative mode for the fourth consecutive day.

Daily studies are predominantly bearish (strong negative momentum / price action below thick daily cloud / daily Tenkan/Kijun-sen in bearish setup) however, oversold conditions and repeated failure to clearly break 0.8893/83 pivots, questions near-term bears and suggests that fresh signal is needed to define direction.

US labor data, today’s key economic event, are likely to generate that signal.

Economists expect that US economy have added 185K new jobs in May, unemployment is forecasted unchanged at 3.9% and slight increase in average earnings is expected (0.3% May f/c from 0.2% Apr), but also take into consideration softer than expected job openings in April and significant drop in private sector payrolls in May.

Generally, softer than expected May numbers, would add to dovish Fed’s stance and increase pressure on dollar, which would result in USDCHF’s sustained break through key 0.8893/83 supports and open way for further retracement of 0.8332/0.9224 rally.

Conversely, upbeat May job figures would offer fresh support to the greenback and generate initial basing signal.

Res: 0.8937; 0.9000; 0.9049; 0.9070

Sup: 0.8883; 0.8838; 0.8778; 0.8729