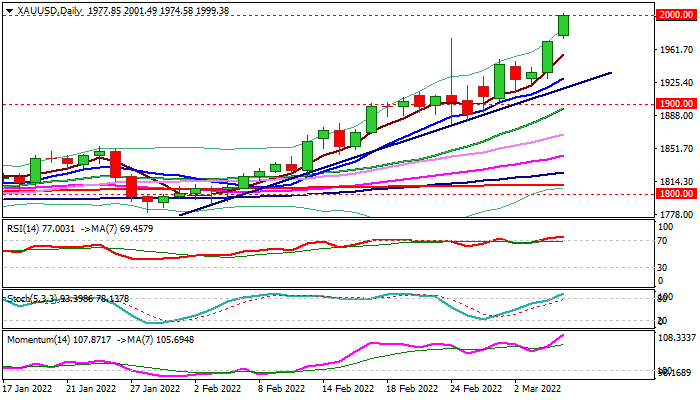

Gold rises above $2000 as escalating crisis boosts safe-haven demand

Spot gold hit $2000 per ounce this morning, for the first time since August 2020, as uncertainty about global economy in light of the consequences of the Russia-Ukraine war and Western sanctions on Russia, as talks about including Russian energy products into the package of restrictions, strongly increased global uncertainty and boosted safe-haven demand.

The yellow metal advanced 2.6% last week, as crisis deepened, but advanced 1.2% only in early Monday’s trading after starting the week with gap higher, signaling that the latest acceleration could extend much higher.

Close above $2000 is needed to confirm strong bullish bias and expose targets at $2015/$2049 (Aug/Sep 2020 peaks) which guard a record high at $2074, posted in Oct 2020.

Further escalation of the crisis could inflate gold price above these levels and unmask next targets at $2100 (round-figure) and $2168 (Fibo 123.6% projection of the rally from $1676 (Mar 2021 low).

Solid supports lay at $1980/74 (broken Fibo 76.4% of $2074/$1676 / Feb 24 spike high), followed by daily Tenkan-sen ($1940) and trendline support at $1925.

Res: 2015; 2049; 2074; 2100

Sup: 1980; 1974; 1950; 1940